Introduction

In the world of financial planning and retirement investments, Gold IRAs have gained significant popularity in recent years. As investors seek ways to diversify their portfolios and safeguard their wealth, gold has emerged as a reliable asset. Edward Jones, a well-known financial services company, offers its version of the Gold IRA. In this comprehensive review, we’ll dive into the Edward Jones Gold IRA to evaluate its features, pros, and cons.

Edward Jones Gold IRA Review – UPDATED 2023

What is an Edward Jones Gold IRA?

Before we delve deeper into this review, let’s understand what an Edward Jones Gold IRA entails. Edward Jones offers investors the opportunity to convert a portion of their traditional Individual Retirement Account (IRA) or 401(k) into a Gold IRA, where physical gold bullion serves as the primary investment.

Pros of Edward Jones Gold IRA

- Reputation and Trust: Edward Jones is a well-established financial services firm with a strong reputation for customer service.

- Diversification: Gold can serve as a valuable asset for diversifying your investment portfolio, helping to mitigate risk during economic uncertainties.

- Professional Guidance: Edward Jones provides personalized financial advisory services to help clients make informed decisions regarding their Gold IRAs.

- Storage Options: Edward Jones offers secure storage options for your gold investments.

Cons of Edward Jones Gold IRA

- High Fees: Edward Jones is known for its relatively high fees, which can significantly impact your overall returns.

- Limited Investment Options: While they offer gold IRAs, their investment options might be more limited compared to specialized gold IRA companies.

- Lack of Transparency: Some customers have reported a lack of transparency regarding fees and performance.

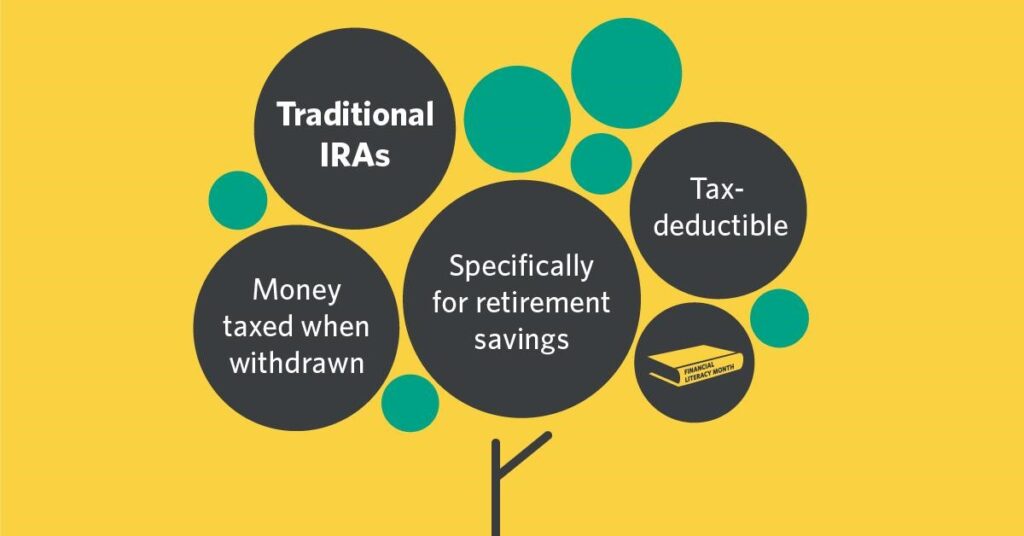

Edward Jones Simple IRA

In addition to their Gold IRA offering, Edward Jones also provides the Simple IRA. Let’s explore what this retirement option entails.

What is an Edward Jones Simple IRA?

An Edward Jones Simple IRA, also known as a Savings Incentive Match Plan for Employees IRA, is a retirement plan designed for small businesses and self-employed individuals. It allows employers and employees to make contributions toward retirement savings.

Features of Edward Jones Simple IRA

- Employee Contributions: Employees can contribute a portion of their salary to their Simple IRA, up to a certain limit.

- Employer Match: Employers are required to match employee contributions, making it an attractive option for businesses looking to provide retirement benefits.

- Tax Advantages: Contributions to a Simple IRA are tax-deductible, reducing taxable income.

- Simplified Administration: The administrative requirements for a Simple IRA are less burdensome compared to some other retirement plans.

A Deep Dive Into The Edward Jones Gold Backed IRA

Edward Jones offers a Gold Backed IRA as a part of its investment offerings. Let’s take a closer look at what this option entails and how it differs from a traditional Gold IRA.

What is an Edward Jones Gold Backed IRA?

An Edward Jones Gold Backed IRA is a retirement account that allows you to invest in gold-related assets, such as gold ETFs (Exchange-Traded Funds), gold mining stocks, or gold bullion.

Pros of Edward Jones Gold Backed IRA

- Diversification: It provides an opportunity to diversify your retirement portfolio by including gold-related assets.

- Liquidity: Unlike physical gold bullion, gold-related assets in a Gold Backed IRA can be more liquid and easier to manage.

Cons of Edward Jones Gold Backed IRA

- Limited to Gold-Related Assets: It may have limited investment options compared to a traditional Gold IRA, which includes physical gold bullion.

- Market Risk: Investments in gold-related assets are subject to market fluctuations and may not provide the same level of security as physical gold.

Edward Jones Vs Fidelity

When considering a Gold IRA, it’s natural to compare Edward Jones with other financial giants like Fidelity. Both companies have their strengths, but let’s break down the key differences.

Edward Jones:

- Edward Jones offers a Gold IRA option but is known for its relatively high fees.

- The company provides personalized financial advisory services, which can be beneficial for investors seeking guidance.

- Limited investment options compared to specialized gold IRA companies.

Fidelity:

- Fidelity is a well-established brokerage firm with a strong reputation.

- It offers a wide range of investment options, including precious metals, allowing for greater diversification.

- Fidelity may have lower fees compared to Edward Jones.

The choice between Edward Jones and Fidelity depends on your individual preferences, investment goals, and tolerance for fees. If you prioritize a broader range of investment options and potentially lower fees, Fidelity could be a better fit. However, if you value personalized financial guidance and are comfortable with Edward Jones’ fee structure, it might be the right choice for you.

Charles Schwab Vs Edward Jones

Another financial heavyweight worth considering in the Gold IRA landscape is Charles Schwab. Let’s compare Charles Schwab with Edward Jones to see how they stack up.

Edward Jones:

- Edward Jones is known for its strong customer service and personalized financial advisory services.

- Offers a Gold IRA option, but fees may be relatively high.

- Limited investment options compared to specialized gold IRA companies.

Charles Schwab:

- Charles Schwab is a renowned brokerage firm with a wide range of investment options, including precious metals.

- It may offer competitive fees compared to Edward Jones.

- Charles Schwab provides a user-friendly online platform for self-directed investors.

Deciding between Charles Schwab and Edward Jones comes down to your investment preferences and priorities. If you value a broader selection of investment options and potentially lower fees, Charles Schwab might be the better choice. However, if you prefer personalized guidance and are comfortable with Edward Jones’ fee structure, it could be a suitable option.

The Augusta Precious Metals Advantage

Now that we’ve compared Edward Jones to other financial giants, let’s introduce you to an alternative that may offer a more compelling Gold IRA solution. Augusta Precious Metals is a company that has gained a reputation for its excellence in the precious metals investment arena.

Why Augusta Precious Metals?

Augusta Precious Metals stands out for several reasons:

1. Lower Fees: Augusta Precious Metals is known for its competitive fee structure, allowing you to maximize your returns.

2. Transparent Pricing: Augusta is committed to transparency, ensuring you’re fully aware of all associated costs.

3. Wide Range of Precious Metals: Augusta offers a diverse selection of precious metals, including gold, silver, platinum, and palladium, enabling you to tailor your portfolio to your specific needs.

4. Expert Guidance: Augusta’s team of experts provides guidance at every step of the process, helping you make well-informed investment decisions.

5. Top-Notch Customer Service: Augusta is renowned for its exceptional customer service, ensuring you have a smooth and hassle-free experience.

6. IRS-Approved Custodian: Augusta works with IRS-approved custodians, ensuring that your Gold IRA complies with all IRS regulations.

Conclusion: Why Augusta Precious Metals is Your Top Choice

As we’ve explored Edward Jones and compared it with Augusta Precious Metals, it’s evident that Augusta stands out as the better choice for individuals looking to convert their IRA into gold. With lower fees, transparent pricing, a wider range of precious metals, top-notch customer service, and a commitment to compliance, Augusta Precious Metals offers a superior Gold IRA solution.

If you’re serious about safeguarding your retirement savings with gold investments, Augusta Precious Metals is the company you can trust. To learn more about Augusta and take the next steps toward securing your financial future, click on the link below.

Click Here To Learn More About Augusta Precious Metals

In conclusion, while Edward Jones is a reputable financial services company, Augusta Precious Metals outshines it when it comes to Gold IRAs. Make an informed decision and secure your retirement with the best possible option.

Conclusion

The decision to invest in a Gold IRA is a significant step toward securing your financial future, especially in uncertain economic times. While Edward Jones and other financial giants offer Gold IRA options, Augusta Precious Metals consistently emerges as the superior choice due to its competitive fees, transparency, diverse range of precious metals, exceptional customer service, and commitment to compliance. So, if you’re ready to take the plunge into the world of Gold IRAs, Augusta Precious Metals is the company to trust.

Remember, your retirement savings are too important to leave to chance. Click on the link below to learn more about Augusta Precious Metals and begin your journey toward a more secure financial future.

Invest wisely and enjoy the peace of mind that comes with a well-diversified and well-protected retirement portfolio.